Bravera Bank

We understand you have personal interests, inspirations and goals for the future. We want to help you define those financial goals and provide solutions that best work for you.

Bravera Bank offers checking accounts to meet both your everyday needs and long-term financial goals.

Free Checking

A free and easy way to manage your banking.

- Free online and mobile banking

- Free bill pay

- Free eStatements

- Free debit card

- No minimum daily balance

- Round up your debit purchases to your savings

Community Rewards Checking

An interest-earning checking account with cash back rewards1, free ATM transactions2 and more.

- Free online and mobile banking

- Free bill pay

- Free eStatements

- Free debit card

- Round up your debit purchases to your savings

- Earns cash rewards1

- Free ATMs2

- Earns 3.04% APY3

55+ Rewards Checking

An interest-earning checking account for customers age 55 and older.

- Free online and mobile banking

- Free bill pay

- Free eStatements

- Free debit card

- Round up your debit purchases to your savings

- Free duplicate checks

- Free tier 2 ID Theft Smart4

- Five free ATM transactions per month

- Earns 1.26% APY5

- Free insurance quote from Bravera Insurance6

Stay secure with contactless payments.

Your new card includes the latest chip technology that supports contactless transactions. These transactions use a unique code, helping to protect against fraud and keep your information safe.

Learn More

Learn More

.png)

Compare Accounts

Order Checks

Personalized Debit Cards

Switch Your Direct Deposit

Parental Controls

Easily add debit card alerts to stay informed about transactions in real-time, ensuring you're aware of any purchases made with your card instantly.

Contactless Payments

Make secure, contactless payments with ease by adding your Bravera Bank debit card to your mobile wallet. Simply link your card through our online banking app and enjoy the convenience of paying on the go—anytime, anywhere.

1 Earn $0.10 per debit card transaction. Requires at least 10 debit card transactions post and settle during that statement cycle.

2 Unlimited ATM fee refunds. Requires $1,000 minimum daily balance or get $20 in ATM refunds per statement cycle with less than $1,000 daily balance.

3 3.04% Annual Percentage Yield on daily balances of $0 – 10,000. Requires at least 10 debit card transactions post and settle during that statement cycle. Daily balances over $10,000 or if 10 debit card transactions do not post and settle during that statement cycle, earn 0.05% APY. The APY is accurate as of 4/15/24. Rates may change after the account is opened. Fees could reduce the earnings on the account.

2 Unlimited ATM fee refunds. Requires $1,000 minimum daily balance or get $20 in ATM refunds per statement cycle with less than $1,000 daily balance.

3 3.04% Annual Percentage Yield on daily balances of $0 – 10,000. Requires at least 10 debit card transactions post and settle during that statement cycle. Daily balances over $10,000 or if 10 debit card transactions do not post and settle during that statement cycle, earn 0.05% APY. The APY is accurate as of 4/15/24. Rates may change after the account is opened. Fees could reduce the earnings on the account.

4 ID Theft Smart requires separate enrollment.

5 1.26% Annual Percentage Yield. Requires a minimum daily balance of $100 to earn interest. The APY is accurate of 10/4/24. Rates may change after the account is opened. Fees could reduce the earnings on the account.

6 Bravera Insurance is an equal opportunity provider. Products and services offered through Bravera Insurance are: * Not a deposit * Not FDIC insured * Not insured by any federal government agency* Not financial institution guaranteed.

5 1.26% Annual Percentage Yield. Requires a minimum daily balance of $100 to earn interest. The APY is accurate of 10/4/24. Rates may change after the account is opened. Fees could reduce the earnings on the account.

6 Bravera Insurance is an equal opportunity provider. Products and services offered through Bravera Insurance are: * Not a deposit * Not FDIC insured * Not insured by any federal government agency* Not financial institution guaranteed.

Additional Digital Services

From monitoring your debit and credit cards and using your phone to pay at stores, Bravera offers solutions to make life easy and keep your finances

.png)

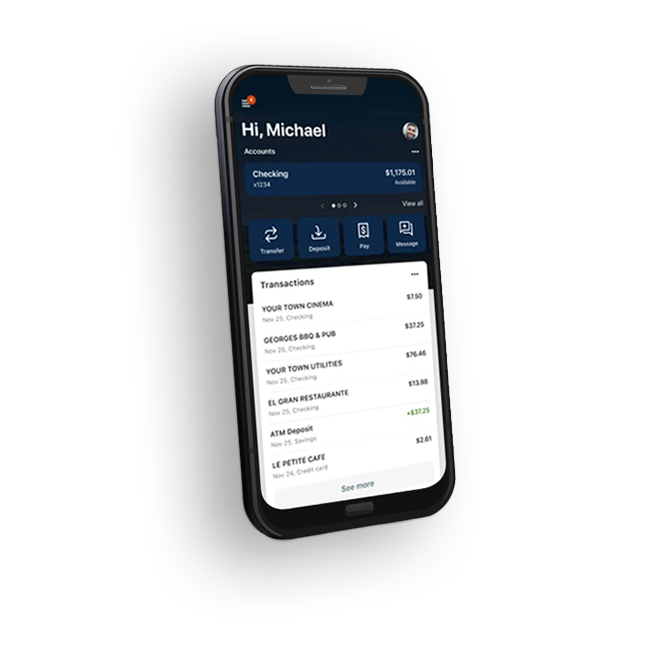

Bank anywhere, anytime.

Pay bills, deposit checks, manage your debit card and switch your direct deposit right from the palm of your hand with Bravera's mobile banking app.